In a Perpetual Inventory System Freight Costs on Purchases Are

Perpetual Inventory - Purchase Discounts. Operating expenses to the seller.

Chapter 5 1 Merchandising Operations And The

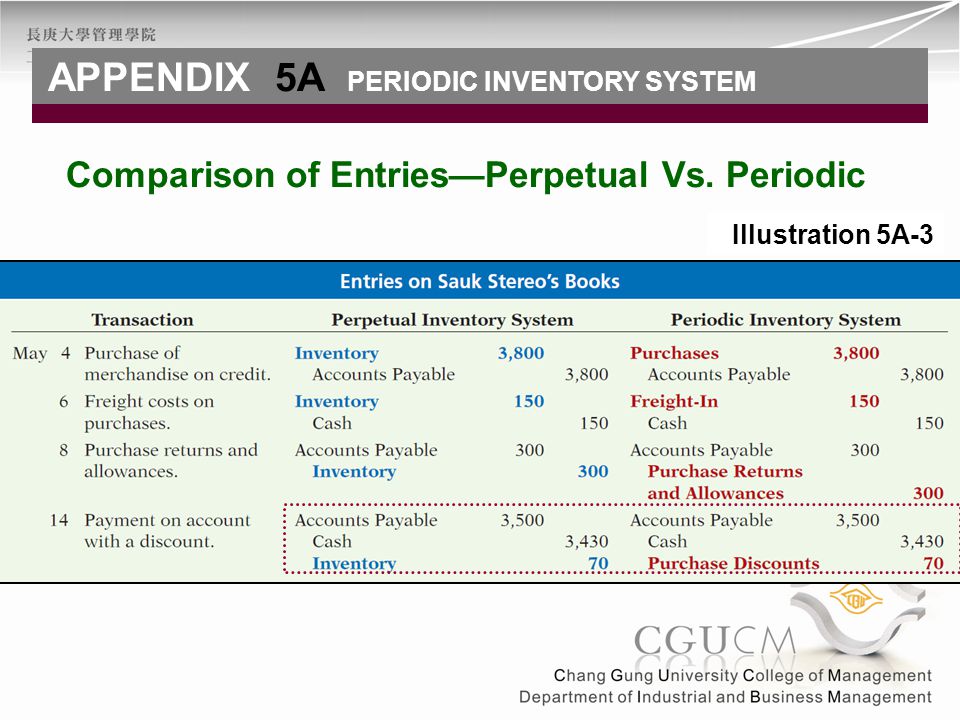

Purchases on account are debited to Purchases.

. The company uses the specific-identification method. Unipal Company purchased 4000 merchandise on credit. In perpetual inventory systems a sale of a stock item increases cost of goods sold COGS Cost of Goods Sold COGS Cost of Goods Sold COGS measures the direct cost incurred in the production of any goods.

Purchased goods in transit should be included in the ending inventory of the buyer if the goods were shipped FOB shipping point. Purchase Returns are debited to Purchase Returns and Allowances. Freight-out account is increased.

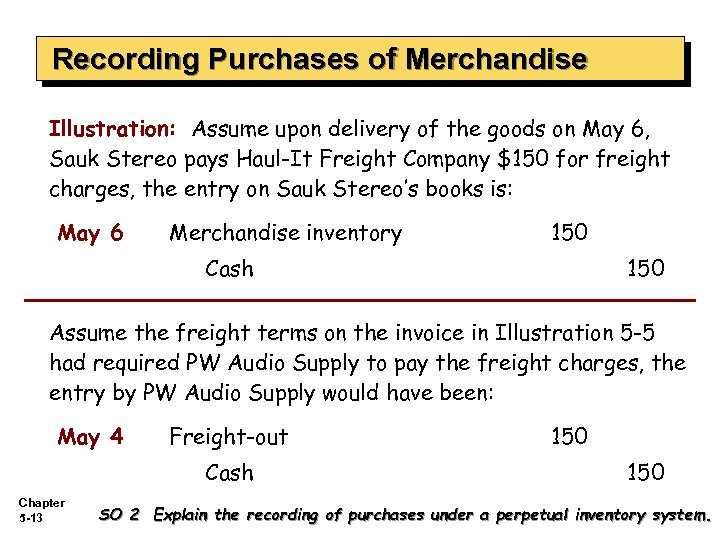

Freight costs are debited to Freight-Out. Freight in is considered a cost of purchasing inventory. Cash Freight costs incurred by the buyer for the transportation of goods is recorded in which account.

C purchase returns are debited to Purchase Returns and Allowances. Merchandise Inventory account is not affected. Using the perpetual inventory system which account is used to record the payment of freight for inventory purchased.

Purchases on account are debited to Purchases. Get help from Accounting Tutors. Purchase returns are debited to Purchase Returns and Allowances.

Purchases on account are debited to Merchandise Inventory c. Under the perpetual inventory system freight costs paid for by the buyer on incoming merchandise are considered. 2 Green Company paid freight cost of 2400 to have the merchandise delivered.

1980900 x 100 200 420. Under a perpetual inventory system when goods are purchased for resale by a company. April 3 Purchased merchandise from DeVito Ltd.

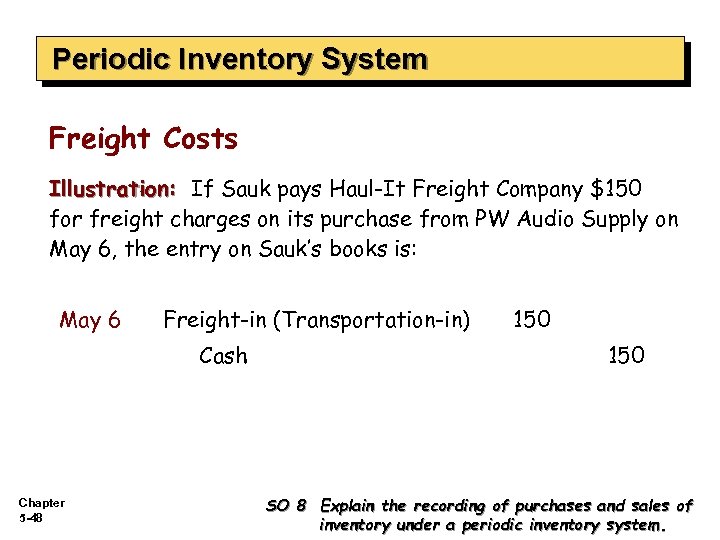

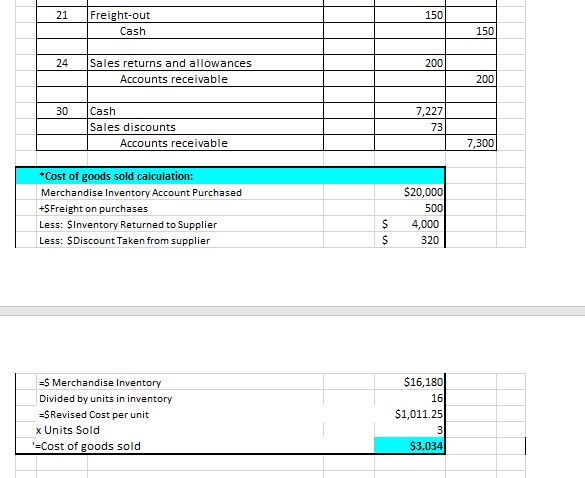

In a periodic inventory system transportation charges for m erchandise are added to net purchases to determine the cost of goods purchased. During the year the company purchases 900 additional units for 1980. The correct answer is.

Likewise the company needs to make journal entry for freight-in by recognizing this cost as a part of merchandise inventory if it uses the perpetual inventory system or recognizing it as a part of net cost of purchases if the. Perpetual Inventory - Purchases. Transportation-In Freight-In and Delivery Expense are all the same account.

Freight Costs are debited to Freight-out d. A purchases on account are debited to Inventory. Up to 24 cash back Merchandise Inventory at Cost Price 3800 Bank or AP 3800 To record the Purchase of Inventory in Perpetual System Purchase Returns Allowances Goods purchased may be damaged defective of inferior quality or they may not meet purchasers specifications Goods may be returned or purchase price may be reduced an allowance Entry to record.

The company had the following inventory transactions in April. Purchases on account are debited to Purchases b. Freight costs are debited to Freight-Out.

Assume that Whole Foods a nationally recognized grocer uses a perpetual inventory system. B purchases on account are debited to Purchases. Freight-in represents the cost of transporting the goods to the buyers place of business.

1 Green Company purchased merchandise inventory that cost 64000 under terms of 210 n30 and FOB shipping point. Bern Company has 100 units costing 200 in beginning inventory. Under a perpetual inventory system when goods are purchased for resale by a company.

Purchases on account are debited to Inventory. For 34160 terms n30 FOB shipping point. The company sold the whole lot to a supermarket chain for 14000 on account.

Under the perpetual Inventory system. At the end of the year 200 units remain unsold. The following information applies to the questions displayed below Assume the perpetual inventory system is used.

If a purchaser using a perpetual inventory system pays the transportation costs then the. Purchases on account are debited to Inventory. Purchase returns are debited to Purchase Returns and Allowances.

Delivery expense account is increased. Cost of Goods Sold C Salec Rn D. Perpetual Inventory System Journal Entries Examples.

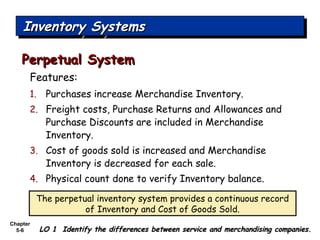

Freight-in cost incurs when the company as the buyer needs to pay for the transportation of goods that it purchases from the suppliers. Merchandise Inventory account is increased. Perpetual Inventory - Freight Costs.

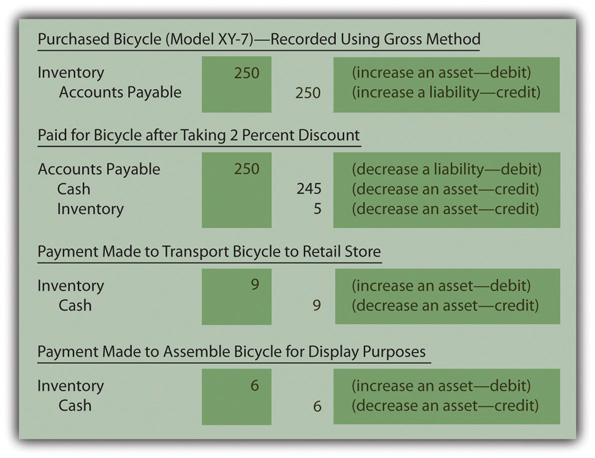

Transportation costs were an additional 350. Ask questions directly from Qualified Online Accounting Tutors. A company that uses the perpetual inventory system purchased 500 pallets of industrial soap for 10000 and paid 750 for the freight-in.

If the perpetual inventory system is used an account entitled Cost of Merchandise Sold is included in the general ledger. Cost of Goods Sold - Perpetual Inventory vs. In a perpetual inventory system companies automatically record journal entries to continuously track purchases sales and cost of goods sold.

D freight costs are debited to Freight-Out. The perpetual inventory system involves tracking and updating inventory records after every transaction of goods received or sold through the use of technology. The expenses that are incurred to obtain merchandise inventory increase the cost of merchandise available for sale.

Under the perpetual inventory system when goods are purchased for resale by a company. Uses a perpetual inventory system. In a perpetual inventory system transportation charges ar e recorded with a debit to the merchandise inventory account.

Part of cost of goods sold. Perpetual Inventory - Purchasing Summary. April 6 The appropriate company paid freight costs of 854 on the merchandise purchased on April 3.

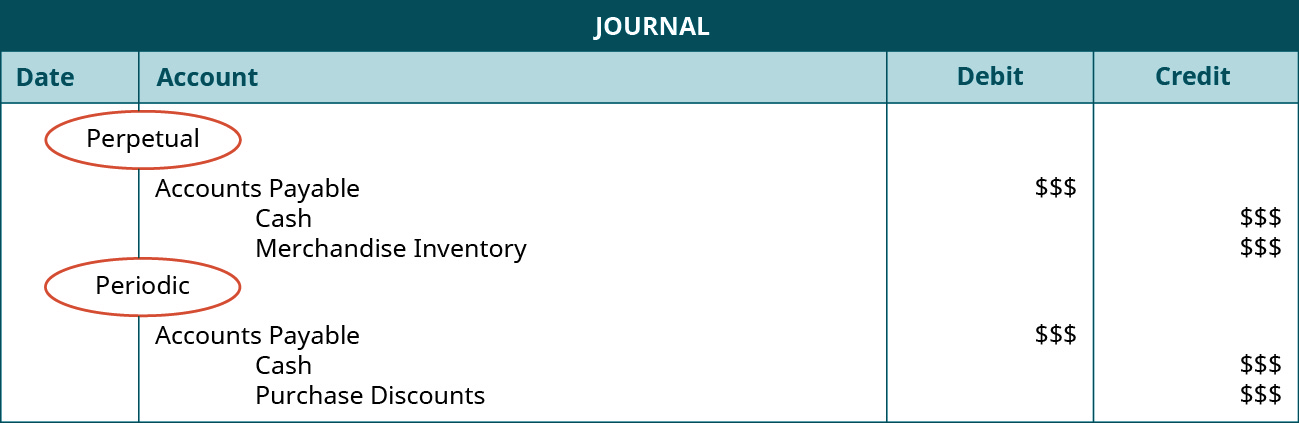

Perpetual inventory system provides a running balance of cost of goods available for sale and cost of goods sold. Under a perpetual inventory system A. Under this system no purchases account is maintained because inventory account is directly debited with each purchase of merchandise.

If Bern Company utilizes the LIFO method ending inventory will be. Event Periodic Inventory System Perpetual Inventory System Seller is granted a purchase allowance of 2500 Purchase Allowance 2500 Account Payable 2500 Purchase Allowance 2500 Account Payable 2500 c.

Periodic Inventory System Online Accounting

Accounting For Merchandising Operations Ppt Download

Chapter 5 Accounting For Merchandising Operations Copyright C 2013 John Wiley Amp Sons Inc Studocu

Perpetual Inventory System Journal Entries Double Entry Bookkeeping

5 An Alternative Inventory System The Perpetual System Bluevelvetrestaurant

Prepare Transactions For Retail Store Fob Exercise 5 1 Youtube

Chapter 5 1 Merchandising Operations And The

Perpetual And Periodic Inventory Systems

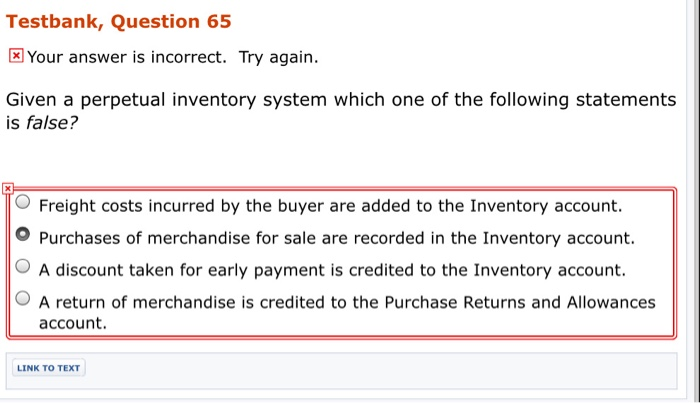

Solved Testbank Question 65 X Your Answer Is Incorrect Try Chegg Com

1 1 Chapter 5 Accounting For Merchandising Operations

Accounting For Merchandising Operations

Compare And Contrast Perpetual Versus Periodic Inventory Systems Principles Of Accounting Volume 1 Financial Accounting

Perpetual Inventory System Journal Entries Pdf

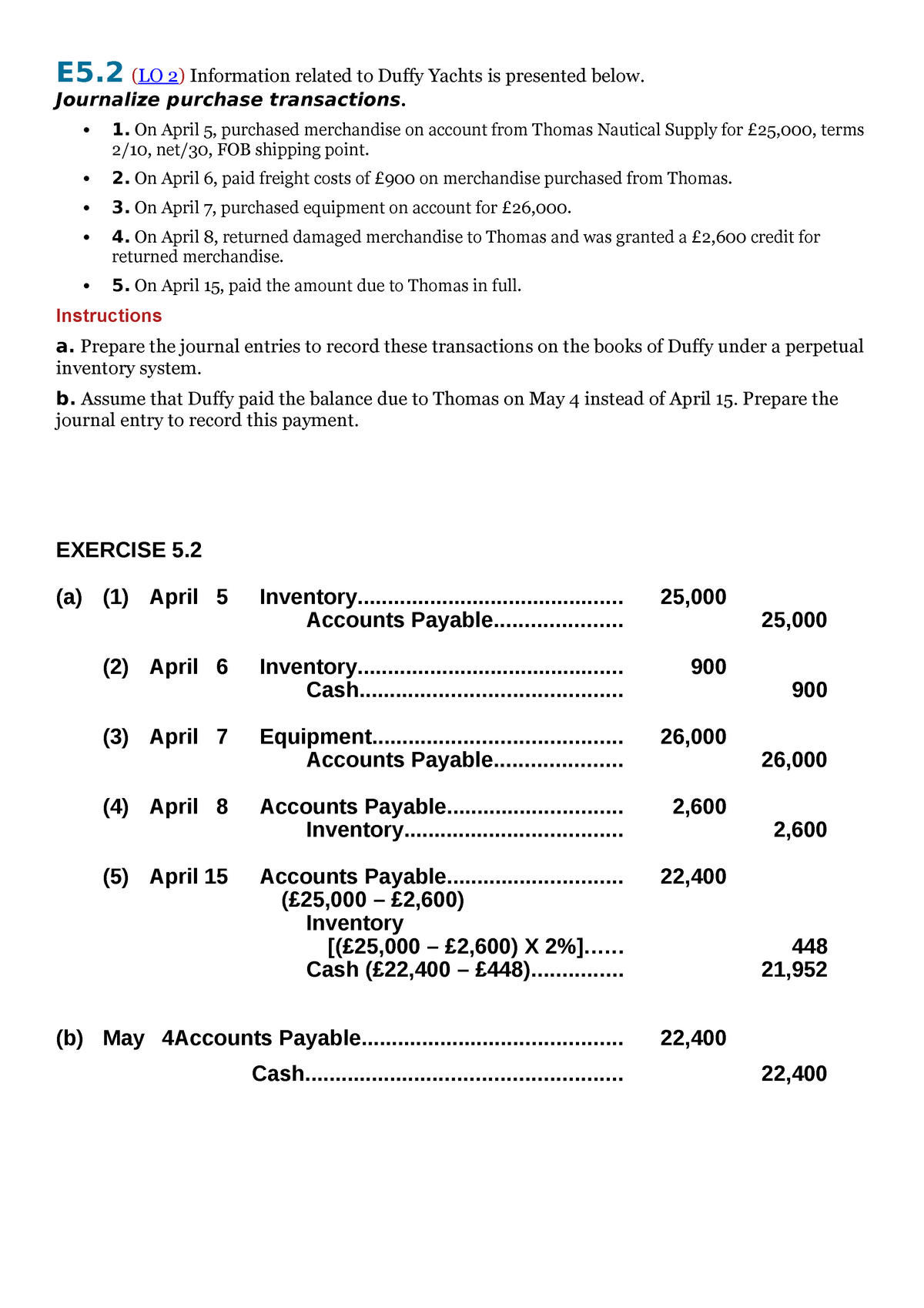

Chapter 5 Exercises To Improve Knowledge E5 Lo 2 Information Related To Duffy Yachts Is Studocu

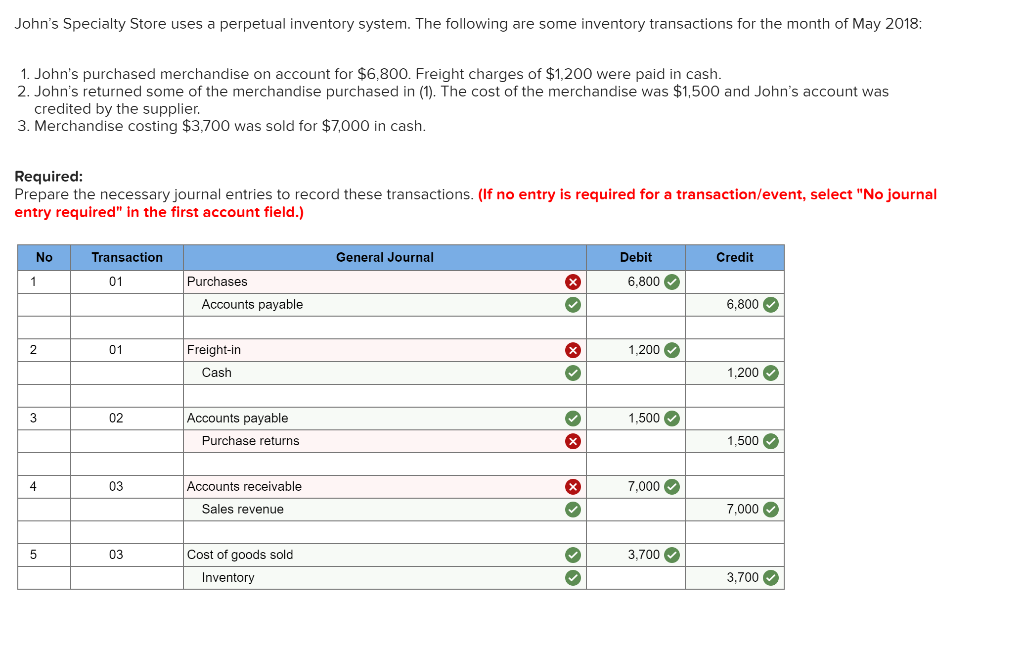

Solved John S Specialty Store Uses A Perpetual Inventory Chegg Com

Solved Part Ii Perpetual Inventory Systems Perpetual Chegg Com

Perpetual Inventory Freight Costs Accounting Video Clutch Prep

Comments

Post a Comment